Introduction

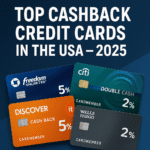

Navigating the world of credit cards can be overwhelming, especially with so many options available in the USA. From cashback and travel rewards to balance transfer benefits, the right credit card can help you save more and build your financial future. After analyzing reviews from trusted financial sources like NerdWallet and Bankrate we’ve compiled this list of the top 5 best credit cards in the USA for June 2025. Whether you’re a first-time user or looking to upgrade your current card, this list is designed to help you choose the best card for your needs.

1. Citi® Double Cash Card

Key Features:

- Earn 2% cashback on every purchase: 1% when you buy and 1% when you pay it off.

- No annual fee.

- 0% Intro APR on balance transfers for 18 months.

Pros:

- Simple cashback structure.

- Great for disciplined payers.

Cons:

- No bonus categories.

- Foreign transaction fee applies.

Recommended For:

- Users looking for a flat-rate cashback card with no annual fee.

2. Chase Freedom Unlimited®

Key Features:

- 1.5% unlimited cashback on all purchases.

- 3% on dining and drugstores, 5% on travel booked through Chase.

- No annual fee.

- 0% Intro APR for 15 months.

Pros:

- Bonus categories.

- High reward potential for frequent travelers and diners.

Cons:

- Requires good to excellent credit.

Recommended For:

- People who spend heavily on travel, dining, and daily essentials.

3. American Express Blue Cash Everyday® Card

Key Features:

- 3% cashback at U.S. supermarkets (up to $6,000 annually).

- 3% cashback at U.S. gas stations and online retail purchases.

- No annual fee.

- Intro APR offers on purchases and balance transfers.

Pros:

- High rewards on daily expenses.

- Strong brand and customer service.

Cons:

- Cashback cap applies.

- Limited international acceptance.

Recommended For:

- Families and individuals with high grocery and gas expenses.

4. Discover it® Cash Back

Key Features:

- 5% cashback on rotating categories (up to $1,500/quarter).

- 1% on all other purchases.

- Cashback Match: Dollar-for-dollar match at the end of first year.

- No annual fee.

Pros:

- Great for strategic spenders.

- Excellent introductory cashback match.

Cons:

- Rotating categories must be activated.

- Some retailers don’t accept Discover.

Recommended For:

- Users who can track categories and optimize rewards.

5. Capital One Quicksilver Cash Rewards

Key Features:

- 1.5% unlimited cashback on every purchase.

- No annual fee.

-

No foreign transaction fees.

- Intro APR for 15 months.

Pros:

- Great for international travelers.

- Flat-rate cashback is easy to manage.

Cons:

- No bonus categories.

- Lower initial welcome bonus.

Recommended For:

- Frequent international shoppers and travelers.

Credit Score Needed for Approval

| Card Name | Recommended Credit Score |

|---|---|

| Citi Double Cash | 700+ (Good to Excellent) |

| Chase Freedom Unlimited | 670+ (Good) |

| Amex Blue Cash Everyday | 670+ (Good) |

| Discover it Cash Back | 680+ (Good) |

| Capital One Quicksilver | 650+ (Fair to Good) |

Comparison Table of All Cards

| Card Name | Cashback | Annual Fee | Foreign Transaction Fee | Intro APR |

|---|---|---|---|---|

| Citi Double Cash | 2% total | $0 | Yes | 18 months (BT only) |

| Chase Freedom Unlimited | Up to 5% | $0 | Yes | 15 months |

| Amex Blue Cash Everyday | Up to 3% | $0 | Yes | Varies |

| Discover it Cash Back | Up to 5% | $0 | No | 15 months |

| Capital One Quicksilver | 1.5% flat | $0 | No | 15 months |

How to Choose the Best Credit Card for You?

When choosing a credit card, consider your lifestyle and spending habits:

- For groceries & gas: Go with Amex Blue Cash Everyday.

- For international travel: Capital One Quicksilver is ideal.

- For overall cashback: Citi Double Cash offers consistent rewards.

- For dining and travel bonuses: Choose Chase Freedom Unlimited.

- For welcome bonus lovers: Discover it Cash Back is unmatched.

Frequently Asked Questions (FAQs)

1. Do all of these cards have no annual fee?

Yes, all five cards on our list have $0 annual fees, making them cost-effective choices.

2. Will applying for multiple cards hurt my credit?

Yes, applying for several credit cards in a short period can lower your credit score temporarily.

3. What is a good credit score to get approved?

Typically, a score of 670 or higher gives you a good chance for approval.

4. Which card is best for international use?

Capital One Quicksilver is great as it has no foreign transaction fees.

5. Can I have more than one of these cards?

Yes, many users maintain multiple cards to maximize rewards across categories.

Final Verdict

Each of these top 5 credit cards offers strong advantages, especially with no annual fees. If you prefer simplicity, flat-rate cashback cards like Citi and Capital One are great. For those who want to maximize categories, Chase and Discover are top picks.

Take your time, compare benefits, and apply for the one that best fits your 2025 financial goals.

👉 Want to learn more about building your credit? Check our article on [Top Ways to Improve Your Credit Score in 2025].

👉 Read our full [Web Story on 5 Best Credit Cards in the USA]

:- https://headlineecho.com/web-stories/credit-cards-usa-2025/

2 thoughts on “Top 5 Best Credit Cards in the USA (June 2025) – Detailed Comparison”