Understanding the Importance of Credit Score

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. In the U.S., scores typically range from 300 to 850. Lenders use this score to determine how likely you are to repay borrowed money. The higher the score, the better.

Why Credit Matters for Students

Even as a student, having a good credit score opens doors:

-

Easier approval for renting apartments

-

Lower interest rates on future loans

-

Better chances of getting a job (some employers check credit!)

-

Qualifying for a cell phone plan or utilities without a deposit

Long-Term Benefits of Good Credit

Building a solid credit history early means:

-

You save money on interest in the future

-

You’ll have financial freedom when buying a car or house

-

You’re less likely to be denied for financial opportunities

When Should Students Start Building Credit?

Ideal Age and Timing

The best time to start is when you’re 18 and have a source of income or parental help. It’s about learning habits, not having tons of money.

Misconceptions About Starting Early

Some students fear that starting too soon could hurt their credit. In reality, responsible early credit use builds your financial foundation.

First Steps to Establishing Credit

Getting a Student Credit Card

Many banks offer student credit cards with:

-

No annual fees

-

Lower credit limits

-

Cash-back or rewards programs

Tip: Choose one with no foreign transaction fees if you plan to study abroad.

Becoming an Authorized User

Ask a parent or guardian to add you as an authorized user to their card. You don’t even have to use it. Their good payment history can help build yours.

Applying for a Credit Builder Loan

Offered by credit unions and online banks, these loans help you build credit while saving money. You make small payments into a locked account, and get the funds later.

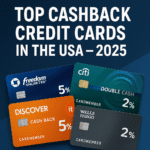

Best Credit Cards for Students (2025 Edition)

Features to Look For

-

No annual fee

-

Low or 0% APR for the first few months

-

Rewards on groceries or school supplies

-

Reporting to all three credit bureaus (Experian, TransUnion, Equifax)

Top 3 Student Cards Right Now

| Credit Card | Key Perks | Ideal For |

|---|---|---|

| Discover it® Student Cash Back | 5% cash back in rotating categories | Everyday spenders |

| Capital One SavorOne Student | Unlimited 3% cash back on dining, entertainment | Social lifestyle |

| Chase Freedom® Student | $20 Good Standing reward each year | Responsible beginners |

How to Use Credit Cards Responsibly

Keeping Utilization Low

Aim to use less than 30% of your credit limit. If your card has a $500 limit, don’t carry more than $150 in balance.

Paying Bills on Time

Even one late payment can drop your score significantly. Set reminders or use autopay to stay on track.

Avoiding Interest and Late Fees

Pay your balance in full every month. That way, you avoid interest charges entirely—free credit use!

Building Credit Without a Credit Card

Rent Reporting Services

Services like RentTrack or Experian Boost allow you to add rent payments to your credit report, helping your score grow.

Utility and Subscription Payments

Some tools track utility bills, Netflix, and other recurring payments, reporting them to credit bureaus. This can add positive history to your file.

Monitoring Your Credit as a Student

Free Tools to Check Your Score

Apps like Credit Karma, Mint, and Experian let you check your credit score for free. Use these to stay informed.

Understanding Credit Reports

You’re entitled to one free credit report from each bureau every year. Visit AnnualCreditReport.com to claim yours.

Habits That Help Grow Credit Over Time

Staying Under Credit Limit

Keep balances low. High balances hurt your credit, even if you pay them off.

Keeping Old Accounts Open

Don’t close your oldest card. The length of credit history boosts your score.

Common Credit Mistakes Students Make

Maxing Out Cards

Using 100% of your limit can tank your score, even if you pay on time.

Applying for Too Many Accounts

Each credit application results in a hard inquiry, which can temporarily lower your score.

Ignoring Payment Deadlines

Late payments stay on your credit report for seven years.

Myths About Student Credit Building

Debunking Popular Misconceptions

-

“You need a high income to build credit.” Not true. Responsible usage matters more.

-

“Checking your own score hurts it.” False! Only hard inquiries (by lenders) affect your score.

How Student Loans Affect Your Credit

Positive vs Negative Impact

Paying on time builds your score. But missed payments hurt badly.

Managing Loans Wisely

Use grace periods, communicate with servicers, and make payments—even small ones—when possible.

Secured Credit Cards: Are They Worth It?

When to Consider Secured Cards

If you’re denied traditional cards, consider secured cards. They require a deposit but are easier to get approved for.

How to Graduate to Unsecured

Use the card responsibly for 6–12 months, and many banks will offer you an unsecured upgrade.

How International Students Can Build Credit

Options Without SSN

Banks like Deserve EDU and Petal offer credit cards for international students without requiring a Social Security Number.

Building U.S. Credit History Safely

Start with secured cards or work with credit unions offering special student programs.

Tools and Apps to Help Students Build Credit

Best Budgeting and Credit Apps

-

Mint – Budgeting and bill tracking

-

CreditWise – Score updates and tips

-

Experian Boost – Add bill payments to your file

Alerts and Reminders

Set up SMS/email alerts for payment due dates and spending limits.

How Long Does It Take to Build Good Credit?

Timelines and What to Expect

With consistent payments, you can reach a score of 700+ in 12–18 months.

Milestones in the Process

-

6 months: Credit file established

-

12 months: Score starts to stabilize

-

18+ months: Qualify for better financial products

Credit Score Milestones in Student Life

From College to First Job

-

Renting your first apartment: 620+ score needed

-

Buying your first car: 680+ for better rates

Credit and Your First Apartment/Car

Landlords and car dealers check credit history. A solid score improves your chances of approval and lower deposits.

FAQs: Build Credit Score as a Student USA

Can I get a credit card with no income?

Yes, if you have a co-signer or apply for a secured/student card. Some banks accept scholarships or allowances as income.

How fast can I build my credit score?

It takes about 6 months to generate a score. Reaching 700+ can take 12–18 months of smart credit behavior.

What credit score do students usually start with?

You don’t have a score until you start using credit. Most new users begin around 500–600.

Is it bad to only have one credit card?

No, it’s fine! Just use it wisely and pay it off regularly. Quality matters more than quantity.

Do student loans hurt or help credit?

They help if you make payments on time. Late or missed payments can hurt your score.

Should I use buy-now-pay-later services?

These don’t always report to credit bureaus and can encourage overspending. Use with caution.

Final Thoughts on Building Student Credit in the U.S.

Key Takeaways

-

Start small, stay consistent

-

Pay on time, every time

-

Use tools and apps to stay on track

Starting Strong, Staying Smart

Learning to manage credit as a student is one of the most valuable financial lessons you’ll carry for life. Be patient, build wisely, and you’ll thank yourself later.

Read Also: Top Cashback Credit Cards in the USA – 2025 (Ranked & Reviewed)